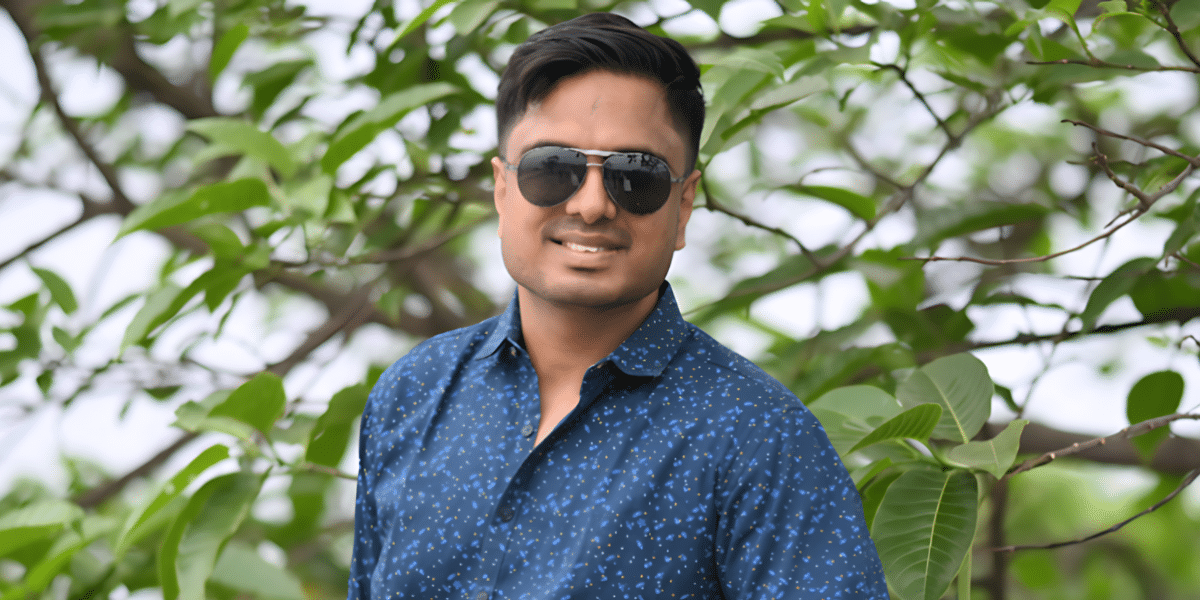

Born and raised in Hamilton, Ontario, Wasseem Dirani began his career in the finance and securities industry. While studying at Western University in London, Ontario, he received a job offer at Prudential Securities. Though he was only two years into his degree, he took it. He later earned his insurance and securities licence and achieved success in that industry before opening his own video rental and sales company. Because of his ability to adapt to any given situation, Dirani was able to scale his business to include four other stores and franchise another two. After six years operating in video rental and sales, he had the opportunity to return to the financial sector and work for a large firm, which he seized readily. Then, in 2000, Wasseem Dirani opened his own business, Taxes to Save, a tax consulting firm where he acts as a financial and tax consultant for new and small businesses. Taxes To Save specializes in providing workable, real-world solutions to the retinue of tax problems faced by companies in today’s unique business climate. Wasseem Dirani currently lives in Hamilton, Ontario.

Why did you decide to go into the tax consultancy industry?

To begin with, having previously worked in the finance and securities industry, I knew the ins and outs of tax law fairly intricately. I knew I could do it well. Also, being a tax consultant is very conducive to opening up one’s own firm, which was something I was always intently focussed on doing eventually. Also, I love helping people and watching them succeed. Providing advice on tax strategies is a great way to do that. So, it was the combination of those three factors.

What trends in your industry excite you?

In recent years, there has been an absolute deluge of people starting their own businesses online. This has been accelerated by the COVID-19 pandemic, of course, but things were trending in that direction even before 2020. I think it’s exciting because it’s sort of democratizing entrepreneurship; far more people are taking the leap to start up new companies in the digital age than they were in previous decades. Also, starting a business online requires significantly less overhead, so owners end up keeping more of the fruits of their labour. It’s easier to succeed launching a business online when compared with opening a brick-and-mortar business, and I love to see people succeed.

What would you tell others looking to get into your industry?

Do not underestimate the power of referrals. By doing a good job and helping clients, they will tell others and recommend you to their family and friends. That is the single best way to get more business. First, because it’s tried, tested, and true. Second, because it’s honest. Third, because of the snowball effect it has—one person tells two people, who then tell two more people each, and so on and so forth. Fourth, because it requires no investment other than hard work and diligence. My firm hasn’t advertised using print, radio, TV, or the internet for ten years. We haven’t needed to because of referrals.

How has tax consultancy changed over the last decade?

One of the interesting things about running a tax consultancy firm is that tax laws are always changing. Pretty much any time the government launches a major new program, the tax laws are tweaked. That is one of the challenges of this business, but it’s also what keeps it from becoming stale. Staying on top of all the new laws, ordinances, edicts, and policies takes a substantial amount of time and energy. So, to answer in detail regarding the last decade would take about a day. Suffice it to say, tax consulting changes significantly from year to year, let alone over the course of ten years.

If you could change one thing you did at the beginning of your career what would it be?

I wouldn’t go to work at a large firm. I did that at the beginning of my career a couple of times, and it was fine, but I always felt a bit stifled by having to participate in a corporate culture that was not of my creation. If I had to go back and do it all again, I would just open my own firm straight away. That was always my goal, anyhow. Although it was a lot of work, if I’d done that in my 20s, the firm would have progressed further by now, and I probably would be happier as a result.

How do you maintain a work/life balance?

It’s all about scheduling and time management. I schedule family time first, and then organize my work schedule around that. It’s one of the reasons I love being my own boss. I don’t have to negotiate with anyone to get the time off I need to spend with my family. I don’t need to justify how important my personal life is to a supervisor or a division head. If there’s a birthday party, a recital, or a ballgame that I need to attend to show support for my kids, I just go.

Explain the proudest day of your professional life.

The proudest day of my professional life was the day I officially opened my own firm. Although there have been many other special days before and since, that one stands head and shoulders above the rest. It changed my life for the better in so many ways—the main one being that from that day onward I was truly in charge of my own future. Nothing compares with how good that feels.

What has been the hardest obstacle you’ve overcome?

Back in the early days of my firm, I took on too much debt in order to expand the business. I didn’t understand at the time that it wasn’t necessary; that so long as I did quality work and was dependable, my business would expand organically. It was a miscalculation on my part, and it was largely a mental error. I overcame it by reevaluating my priorities and seeing the bigger picture. And by paying back the debt, of course.

What is one piece of advice you’ve never forgotten?

Don’t review documents or forms immediately after completing them. Take a break, or move on to a different piece of work for a while, then go back and review the document after some time has passed. The human mind is constructed in such a way that by diverting attention away from a document for a period of time and then returning to review it, errors that might be glossed over become more apparent and obvious. I guess there’s some science that backs that fact up, from what I understand.

What does success look like for you?

Success is independence, financial and otherwise. Success is not having to ask permission to take a week off work to take your family on a vacation. Success is never having to borrow money to pay your bills. Success is being able to relax in the knowledge that you can take care of yourself and your loved ones on your own terms. Given that as the criteria, I would say that I’m successful.

What is one piece of advice you’d like to leave our readers with?

It ultimately pays major dividends to retain the services of a solid and reputable tax consultant. Whatever fees you might pay for their services are more than made up in the savings they will provide you with year over year. It’s one of the most reliable investments a person or business can make.